Social Security or Individual Taxpayer Identification Number.If you receive this form, ISS recommends keeping it for your records. Nonresidents for tax purposes CANNOT use this form when filing a tax return.Shows educational expenses for each tax year.Taxes are not withheld from "independent contractor" income.

If the income shown on the 1099-MISC is very large, you may owe taxes. Sometimes off-campus jobs for CPT, OPT, or Academic Training use this form to document job income instead of the W-2. Used to show "independent contractor" income.Bank interest is not taxable for nonresident aliens, so you do not need to consider these forms when preparing your tax return.Shows income from interest or dividends.If you received such payments from RIT, your 1042-S form will be available to you through the GLACIER system.

#TURBOTAX RETURN COPY HOW TO#

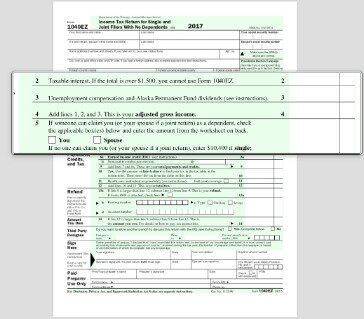

Summarizes the total amount of wages earned during the year and the amount of money withheld for any taxes (federal, state, and local).ġ042-S (Foreign Person's US Source Income Subject to Withholding).Copies of the forms are submitted to the IRS as part of your tax return. These documents contain important information that you’ll enter into Sprintax to complete your tax return. You may receive some or all of the forms listed below. It is important to note that you may not receive the same forms received by your friends. Every person's tax situation is different.

0 kommentar(er)

0 kommentar(er)